Fractal Industries IPO

BSE SMELot: 200Construction

About Fractal Industries

Fractal Industries Limited is a Mumbai-based industrial manufacturing company incorporated in January 2020. The company operates in the industrial packaging and engineered products space, catering primarily to B2B customers across India. Originally incorporated as Fractal Industries Private Limited, the company was converted into a public limited company in March 2025 as part of its capital market readiness ahead of the IPO

GMP History

| Date | GMP | Est. Listing |

|---|---|---|

| 16 Feb 2026 | +₹4 | ₹220 |

| 15 Feb 2026 | +₹4 | ₹220 |

| 14 Feb 2026 | +₹4 | ₹220 |

| 13 Feb 2026 | +₹6 | ₹222 |

| 12 Feb 2026 | +₹5 | ₹221 |

| 11 Feb 2026 | +₹7 | ₹223 |

Key Corporate Details

Particulars | Details |

|---|---|

Company Name | Fractal Industries Limited |

CIN | U14101MH2020PLC335773 |

Date of Incorporation | January 9, 2020 |

Registered Office | Andheri East, Mumbai, Maharashtra |

IPO Platform | BSE SME |

Business Nature | Industrial manufacturing & supply |

Promoters | Mr. Pankaj Bishwanath Agrawal & Mrs. Priti Pankaj Agrawal |

Evolution & Growth Journey

2020–2022: Setup of manufacturing operations and supplier ecosystem

2023–2024: Scale-up phase with revenue expansion and customer diversification

2025: Conversion to public limited company, governance restructuring

2026: SME IPO to fund working capital and growth initiatives

This relatively short but focused operating history positions Fractal Industries as a young, growth-oriented manufacturing SME, rather than a legacy business.

Products & Services Offered

Segment | Description |

|---|---|

Core Manufacturing | Industrial components and engineered products |

Custom Solutions | Client-specific product design and fabrication |

B2B Supply | Long-term supply contracts with industrial customers |

The company operates on a made-to-order + repeat supply model, allowing better inventory control and margin visibility.

Industry Background & Market Environment

Industry Classification

Fractal Industries operates within India’s industrial manufacturing and engineered products ecosystem, which is closely linked to:

Infrastructure

Logistics

Consumer goods manufacturing

Industrial supply chains

Indian Industrial Manufacturing Market – Snapshot

Indicator | Data |

|---|---|

India Manufacturing GVA Share | ~17% of GDP |

Government Target | 25% of GDP by 2030 |

Policy Support | Make in India, PLI Schemes |

SME Contribution | ~30% of manufacturing output |

(Source: RHP)

Growth Drivers

Rising domestic manufacturing replacing imports

Expansion of MSME-led supply chains

Infrastructure and logistics investments

Demand for customized, cost-efficient industrial products

Competitive Landscape

The industry is:

Highly fragmented

Dominated by SMEs

Competitive on pricing, delivery timelines, and customization

Fractal Industries competes primarily with regional unlisted manufacturers, rather than large listed conglomerates.

Industry Outlook (Medium Term)

The sector is expected to grow at a steady high-single-digit CAGR, supported by:

Government manufacturing push

Capex revival in private sector

Supply chain localization

Company Business Overview

What Does Fractal Industries Do?

Fractal Industries is engaged in:

Manufacturing industrial products

Supplying engineered solutions to B2B clients

Maintaining long-term customer relationships

Business Model Explained

Stage | Company Role |

|---|---|

Raw Material Procurement | Multiple vendors to reduce dependency |

Manufacturing | In-house production |

Quality Control | Batch-level inspection |

Distribution | Direct dispatch to customers |

After-Sales | Relationship-based repeat orders |

This asset-light yet controlled manufacturing model allows scalability without excessive fixed costs.

Target Customers

Industrial manufacturers

Logistics & infrastructure-linked businesses

SME & mid-corporate buyers

The company does not depend on a single customer, reducing concentration risk.

Value Chain Position

Fractal Industries sits in the mid-value segment of the industrial supply chain — balancing:

Cost competitiveness

Customization capability

Delivery reliability

Key Regulations & Compliance Framework

Operating as an Indian manufacturing SME, the company is subject to multiple regulatory frameworks.

Major Applicable Regulations

Regulation | Applicability |

|---|---|

Companies Act, 2013 | Corporate governance & disclosures |

SEBI ICDR Regulations | IPO and capital raising |

GST Laws | Indirect taxation |

Income Tax Act | Direct taxation |

Factory & Labour Laws | Workforce compliance |

MSME Regulations | Classification & benefits |

IPO-Related Compliance

SEBI ICDR Regulations, 2018

SME Exchange Listing Regulations

Continuous disclosure obligations post listing

The company has appointed independent directors, formed statutory committees, and strengthened internal controls in line with IPO norms.

Risk Profile – Key Investor Considerations

Business Risks

Risk | Explanation |

|---|---|

SME Scale Risk | Limited operating scale compared to large peers |

Customer Pricing Pressure | B2B customers negotiate aggressively |

Input Cost Volatility | Raw material price fluctuations |

Operational Risks

Risk | Impact |

|---|---|

Manufacturing Disruptions | Delays in order fulfillment |

Vendor Dependence | Supply chain interruptions |

Skilled Labour Availability | Production efficiency |

Financial Risks

Risk | Details |

|---|---|

Working Capital Intensive | Cash locked in receivables & inventory |

SME Platform Liquidity | Lower post-listing liquidity compared to mainboard |

These risks are clearly disclosed in the RHP and are typical of manufacturing SMEs at this growth stage

Promoters and Ownership Group

Who Are the Promoters?

The company is promoted by:

Mr. Pankaj Bishwanath Agrawal

Mrs. Priti Pankaj Agrawal

They are collectively referred to as the Promoter Group under SEBI regulations.

Promoters’ Role in the Business

The promoters have played a hands-on role since inception, overseeing:

Business strategy

Operational scaling

Financial discipline

IPO readiness and governance transition

Mr. Pankaj Bishwanath Agrawal currently serves as the Chairman and Managing Director, giving him executive control over both strategic and day-to-day matters.

Promoter Background Snapshot

Name | Role | Key Contribution |

|---|---|---|

Pankaj Bishwanath Agrawal | Chairman & Managing Director | Strategy, operations, leadership |

Priti Pankaj Agrawal | Promoter | Oversight and promoter support |

The promoters have committed to minimum promoter contribution and lock-in requirements as mandated under SEBI ICDR Regulations, which aligns their interests with public shareholders.

Group Entities and Associate Companies

Presence of Group Companies

As per disclosures in the Red Herring Prospectus, Fractal Industries Limited does not have subsidiaries.

However, the company has identified group entities based on:

Past related party transactions

Common promoter linkage

Nature of Group Relationships

Aspect | Status |

|---|---|

Subsidiaries | None |

Joint Ventures | None |

Material Associate Companies | Disclosed in RHP |

Nature of Transactions | Limited, arms-length |

Importantly, no group entity materially controls or influences the company’s operations, reducing governance complexity for investors.

Leadership Team and Key Executives

Board of Directors – Overview

The company has constituted a balanced board comprising:

Executive directors

Non-executive directors

Independent directors

This structure is aligned with Companies Act, 2013 and SEBI Listing Regulations applicable to SME-listed entities.

Key Managerial Personnel (KMP)

Name | Designation | Responsibility |

|---|---|---|

Pankaj Bishwanath Agrawal | Chairman & Managing Director | Overall leadership & strategy |

Vikas Tekriwal | Executive Director | Business operations |

Anoop Kumar Agarwal | Chief Financial Officer | Finance, accounts, compliance |

Kruti Parshwa Shah | Company Secretary & Compliance Officer | Legal & regulatory compliance |

Management Strength

Combination of promoter-led execution and professional management

Dedicated CFO and CS ensure financial discipline and regulatory adherence

Separation of operational and compliance roles improves transparency

Corporate Governance and Board Committees

Governance Philosophy

Ahead of the IPO, the company has significantly strengthened its governance framework by:

Inducting independent directors

Forming statutory committees

Adopting internal control and disclosure policies

Statutory Board Committees

Committee | Key Role |

|---|---|

Audit Committee | Financial reporting, audits, internal controls |

Nomination & Remuneration Committee | Director appointments & pay |

Stakeholders’ Relationship Committee | Investor & shareholder grievance handling |

These committees function in line with Sections 177 and 178 of the Companies Act, 2013.

Governance Takeaway for Investors

For an SME IPO, Fractal Industries demonstrates:

Early governance readiness

Compliance-first approach

Promoter accountability through structured oversight

Legal Matters and Regulatory Proceedings

Litigation Status

According to the RHP disclosures:

The company

Promoters

Directors

do not face any material litigations that could materially impact business operations or financial position.

Legal Risk Assessment

Category | Status |

|---|---|

Criminal Proceedings | None material |

Civil Litigations | Routine, non-material |

Regulatory Actions | None significant |

This clean legal slate is a positive governance indicator for prospective investors.

Government and Statutory Approvals

Key Licenses & Approvals

Fractal Industries holds all approvals required to conduct its business lawfully.

Statutory Compliance Snapshot

Approval / Registration | Status |

|---|---|

Certificate of Incorporation | Valid |

GST Registration | Active |

PAN & TAN | Active |

Factory & Labour Registrations | Complied |

Shops & Establishment License | In place |

Environmental Compliance | As applicable |

IPO-Specific Approvals

In-principle listing approval from BSE SME

SEBI ICDR compliance filings completed

Registrar, merchant banker, and monitoring agency appointed

Financial Performance Overview

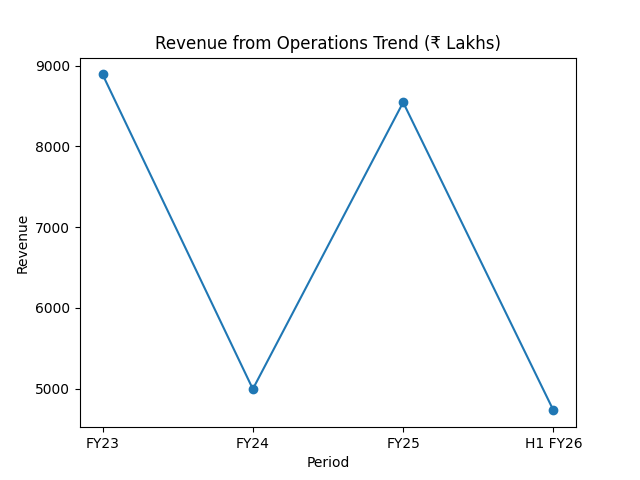

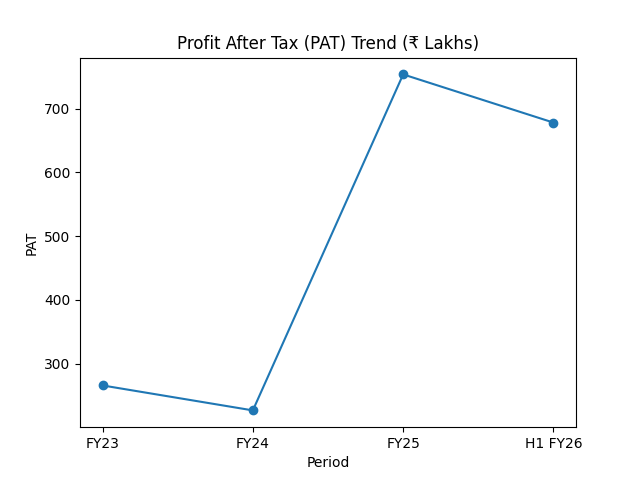

Fractal Industries Limited has demonstrated strong growth and sharp improvement in profitability, particularly in FY25 and H1 FY26. The company transitioned from a low-margin phase to a high-margin operating profile, driven by scale efficiencies and better cost control.

Summary of Restated Financial Performance

(₹ in lakhs)

Particulars | H1 FY26* | FY25 | FY24 | FY23 |

|---|---|---|---|---|

Revenue from Operations | 4,729.73 | 8,544.87 | 4,994.40 | 8,891.11 |

Total Income | 4,733.40 | 8,551.29 | 5,000.85 | 8,891.11 |

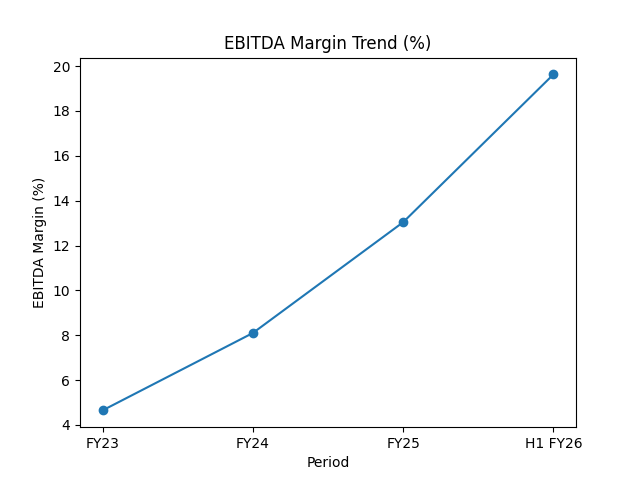

EBITDA | 929.15 | 1,114.81 | 405.23 | 413.12 |

EBITDA Margin (%) | 19.63% | 13.04% | 8.10% | 4.65% |

Profit After Tax (PAT) | 678.17 | 753.76 | 226.68 | 265.83 |

PAT Margin (%) | 14.34% | 8.82% | 4.54% | 2.99% |

*H1 FY26 refers to period ended 30 September 2025

Investor Insight

Margins have expanded sharply over three years

FY25 marked a step-change in profitability

H1 FY26 margins indicate sustainability of improved performance

Borrowings and Financial Obligations

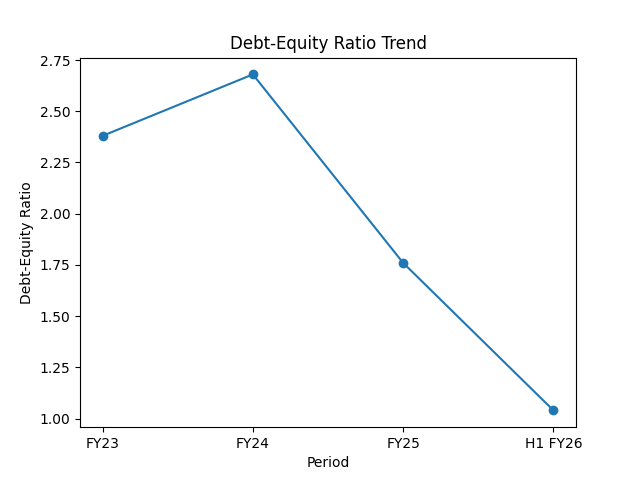

Fractal Industries operates a working-capital-intensive business, which reflects in its borrowing profile. However, leverage has reduced significantly over time.

Borrowings Snapshot

(₹ in lakhs)

Particulars | H1 FY26 | FY25 | FY24 | FY23 |

|---|---|---|---|---|

Long-term Borrowings | 817.61 | 900.95 | 972.82 | 403.05 |

Short-term Borrowings | 1,644.97 | 1,859.98 | 1,215.22 | 1,001.87 |

Total Borrowings | 2,462.58 | 2,760.93 | 2,188.04 | 1,404.92 |

Debt–Equity Ratio | 1.04x | 1.76x | 2.68x | 2.38x |

Investor Insight

Debt-equity reduced from 2.68x (FY24) to 1.04x (H1 FY26)

Indicates improving balance sheet strength

IPO proceeds are expected to further ease working capital pressure

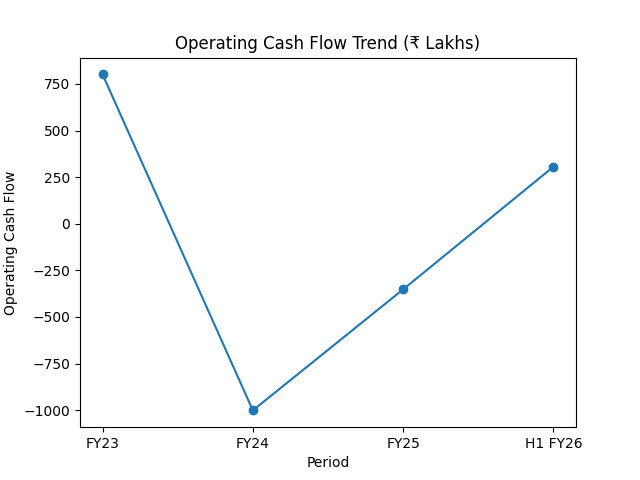

Cash Flow Position

While the company is profitable, cash flows have been volatile, mainly due to inventory and receivables movement — common in manufacturing and supply-chain-linked businesses.

Cash Flow Summary

(₹ in lakhs)

Particulars | H1 FY26 | FY25 | FY24 | FY23 |

|---|---|---|---|---|

Operating Cash Flow (OCF) | 306.09 | (351.93) | (1,001.43) | 801.44 |

Investing Cash Flow | (12.43) | (43.18) | (485.86) | (288.30) |

Financing Cash Flow | (284.65) | 393.48 | 686.45 | 293.48 |

Net Change in Cash | 9.01 | (1.63) | (800.84) | 806.62 |

Closing Cash Balance | 14.48 | 5.48 | 7.11 | 807.95 |

Investor Insight

Negative OCF in FY24 & FY25 due to working capital expansion

H1 FY26 shows positive operating cash flow

Cash flows expected to stabilize post-IPO

Important Financial Ratios

Fractal Industries shows strong improvement in profitability and returns, supported by operating leverage.

Key Financial Ratios

Ratio | H1 FY26 | FY25 | FY24 | FY23 |

|---|---|---|---|---|

EBITDA Margin | 19.63% | 13.04% | 8.10% | 4.65% |

Net Profit Margin | 14.34% | 8.82% | 4.54% | 2.99% |

Return on Equity (ROE) | 34.52% | 63.20% | 32.27% | 58.18% |

Return on Capital Employed (ROCE) | 18.99% | 25.07% | 12.33% | 19.14% |

Debt–Equity Ratio | 1.04x | 1.76x | 2.68x | 2.38x |

Basic EPS (₹) | 12.15 | 150.75 | 45.34 | 53.17 |

Investor Interpretation

High ROE driven by margin expansion and leverage

Improving ROCE shows better capital efficiency

Declining debt ratios reduce financial risk

Management Discussion & Business Strategy (MD&A)

The management of Fractal Industries Limited highlights that the recent improvement in financial performance is the result of:

Better capacity utilization

Focus on higher-margin orders

Tighter control over operating and finance costs

Rationalisation of customer mix

Management Outlook

Continue scaling operations without aggressive capex

Improve working capital efficiency

Strengthen balance sheet post-IPO

Maintain margin discipline

Investor takeaway:

Management is prioritizing profitability-first growth, which is critical for SME IPO sustainability.

Purpose of the IPO (Use of Funds)

The IPO is a 100% fresh issue, meaning all proceeds go to the company.

Proposed Use of IPO Proceeds

Objective | Description |

|---|---|

Working Capital | Funding day-to-day operational requirements |

General Corporate Purposes | Business expansion, admin, contingencies |

Issue Expenses | IPO-related costs |

Why this matters:

No promoter exit → strong confidence signal.

Pricing Logic & Valuation Basis

The issue price is determined through the book-building process, considering:

Earnings growth

Net worth

Return ratios

Comparable SME peers

Key Valuation Anchors

Metric | Observation |

|---|---|

EPS | Strong improvement in FY25 & H1 FY26 |

ROE | High, driven by margin expansion |

Debt Profile | Rapid deleveraging trend |

Peer Comparison | Valuation aligned with SME manufacturing peers |

Investor note:

Valuation reflects growth-stage SME pricing, not mature large-cap multiples.

Share Capital Structure (Pre & Post IPO)

Equity Capital Snapshot

Particulars | Pre-Issue | Post-Issue |

|---|---|---|

Equity Shares | 55,80,267 | 78,48,867 |

Paid-up Capital (₹ lakhs) | 558.03 | 784.89 |

Shareholding Pattern (Post IPO – Indicative)

Category | Approx. Holding (%) |

|---|---|

Promoters & Promoter Group | ~71% |

Public Shareholders | ~29% |

Lock-in:

Promoter shares are subject to SEBI-mandated lock-in, aligning interests with investors.

Dividend Policy

The company has not declared dividends in the last three years.

Dividend Approach

Focus on reinvestment during growth phase

Dividend decisions will depend on:

Cash flows

Capex needs

Financial condition

This is a growth stock, not a dividend yield play (for now).

Tax Considerations for Investors

Capital Gains Tax (Indicative)

Holding Period | Tax Treatment |

|---|---|

< 12 months | Short-Term Capital Gains (STCG) |

> 12 months | Long-Term Capital Gains (LTCG) |

Taxes depend on:

Investor category

Holding period

Applicable tax laws at the time of sale

Related Party Transactions

The company has disclosed related party transactions, primarily involving:

Group entities

Promoter-linked parties

Key Points

Transactions are at arm’s length

No material adverse impact identified

Fully disclosed in financial statements

Key Agreements & Legal Contracts

Major IPO-Related Agreements

Agreement | Purpose |

|---|---|

Merchant Banker Agreement | IPO management |

Registrar Agreement | Share allotment & records |

Market Making Agreement | Post-listing liquidity |

Underwriting Agreement | Issue support |

Issue Details & Allocation Structure

Issue Snapshot

Particular | Details |

|---|---|

Issue Type | 100% Fresh Issue |

Face Value | ₹10 per share |

Exchange | BSE SME |

Market Maker Portion | Included |

Investor Allocation

Category | Allocation |

|---|---|

QIBs | Up to 50% |

NIIs | Minimum 15% |

Retail / Individual | Minimum 35% |

Rights of Equity Shareholders

Equity shareholders are entitled to:

Voting rights

Dividend rights (if declared)

Participation in corporate actions

Share in surplus on liquidation

Rights are proportional to shareholding.

Other Statutory & Regulatory Disclosures

The company confirms compliance with:

Companies Act, 2013

SEBI ICDR Regulations

SME Listing Regulations

No material omissions or misleading disclosures reported as per RHP.