Marushika Technology IPO

BSE SMELot: 1200Construction

About Marushika Technology

Marushika Technology Limited is an India-based IT and telecom infrastructure solutions provider with a strong focus on government and enterprise clients. Incorporated in 2010, the company has evolved from an advisory-led setup into a full-fledged B2B and B2G technology services company, delivering end-to-end solutions across IT infrastructure, networking, cybersecurity, surveillance systems, and smart city applications. Marushika supports clients in setting up data centres, active networking, power management systems, and advanced security infrastructure, along with installation and maintenance services. In recent years, it has also expanded into defence auto-tech solutions, offering maintenance, refurbishment, and reverse engineering services for military vehicles. Headquartered in Delhi–NCR, the company has successfully completed 150+ projects across sectors such as defence, transportation, education, healthcare, and public infrastructure. With ISO certifications for quality management and information security, Marushika Technology Limited positions itself as a reliable technology partner aligned with India’s digital and infrastructure growth initiatives.

Company Profile

Marushika Technology Limited was incorporated on July 3, 2010, originally as Marushika Traders and Advisors Private Limited. Over the years, the company evolved through multiple name changes and corporate restructuring, reflecting its transition from advisory services to a technology-driven infrastructure company. In December 2024, it was renamed to its present identity, Marushika Technology Limited, and converted into a public limited company in preparation for listing

RHP

.

Key Company Details

Particulars | Details |

|---|---|

CIN | U62099DL2010PLC205156 |

Date of Incorporation | July 03, 2010 |

Registered Office | East Delhi, India |

Corporate Office | Noida, Uttar Pradesh |

Sector | Information Technology Services |

Industry | IT & Telecom Infrastructure |

Listing Platform | NSE Emerge (SME) |

Industry Background and Market Environment

Marushika operates within India’s IT Infrastructure and Telecom Services industry, a key pillar of the country’s digital economy. The IT sector contributed 7.5% to India’s GDP in FY2023, employing over 5.7 million people nationwide. Growth is driven by data center expansion, cloud adoption, cybersecurity demand, and government digital initiatives such as Digital India and Smart Cities.

Industry Growth Drivers

Expansion of government IT infrastructure

Rising cybersecurity spending

Defense modernization

Smart city and surveillance projects

Company Business Overview

Marushika Technology Limited is engaged in B2B and B2G (Business-to-Government) operations, providing end-to-end IT and telecom infrastructure solutions.

Core Offerings

Segment | Services |

|---|---|

IT Infrastructure | Data centers, networking, power systems |

Cybersecurity | Data protection, network security |

Surveillance | Advanced security & monitoring systems |

Smart Solutions | Smart parking, lighting, waste management |

Defence Auto-Tech | Maintenance & refurbishment of military vehicles |

The company has completed 150+ projects and had an order book of ₹3,545.45 lakh as of December 31, 2025

Key Regulations and Compliance Framework

Marushika’s operations are governed by multiple regulatory frameworks:

Companies Act, 2013

SEBI (ICDR) Regulations, 2018

Income Tax Act, 1961

GST Act, 2017

FEMA regulations

Defence procurement norms (for defence projects)

The company is also ISO 9001:2015 and ISO/IEC 27001:2022 certified

Risk Profile

Key risks disclosed in the RHP include:

Dependence on government contracts

Working capital intensity

Delays in project execution

Legal and regulatory risks

Industry competition and pricing pressure

These risks could impact margins, cash flows, and future growth

Promoters and Ownership Group

The company is promoted by:

Name | Role |

|---|---|

Ms. Monicca Agarwaal | Promoter |

Mr. Jai Prakash Pandey | Promoter & Director |

Ms. Sonika Aggarwal | Promoter & Executive Director |

The promoters bring over 20+ years of experience in IT, telecom, finance, and operations

Group Entities and Associate Companies

Key Group Entities

Entity Name |

|---|

Marushika Infrastructure Services Pvt. Ltd. |

Dhruven Enterprises Pvt. Ltd. |

Naivedyam Info Solutions Pvt. Ltd. |

Wholly Owned Subsidiary

Marushika Technology Advisors PTE. Ltd. (Singapore) – cybersecurity consultancy

Leadership Team and Key Executives

Name | Position |

|---|---|

Mr. Jai Prakash Pandey | Director |

Ms. Sonika Aggarwal | Executive Director & CFO |

Ms. Kavin Arora | Company Secretary & Compliance Officer |

Corporate Governance and Board Committees

The company has constituted statutory committees in line with the Companies Act:

Audit Committee

Nomination & Remuneration Committee

Stakeholders’ Relationship Committee

Legal Matters and Regulatory Proceedings

As per the RHP, the company has no material litigations that could materially impact its operations or financial position

Government and Statutory Approvals

Approval | Authority |

|---|---|

Certificate of Incorporation | ROC |

PAN & TAN | Income Tax Dept |

GST Registration | GST Authority |

ISO Certifications | Accredited Agencies |

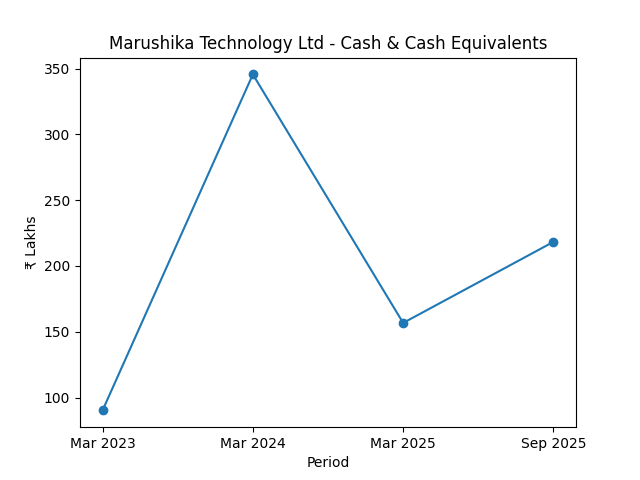

Financial Performance Overview

Period | Amount |

|---|---|

Mar 2023 | 90.23 |

Mar 2024 | 345.55 |

Mar 2025 | 156.69 |

Sep 2025 | 218.30 |

Borrowings and Financial Obligations

The company uses working-capital facilities to support project execution. Borrowings are aligned with operational needs and disclosed in the financial indebtedness section

Cash Flow Position

Marushika generates cash primarily from operating activities, while investing cash flows relate to equipment and infrastructure. Financing cash flows include borrowings and repayments.

Important Financial Ratios

Earnings Per Share (EPS)

Financial Year | EPS (₹) |

|---|---|

FY 2022–23 | 0.74 |

FY 2023–24 | 5.50 |

FY 2024–25 | 10.21 |

Sept 30, 2025 (Stub Period) | 5.04 |

Weighted Average EPS: ₹7.06

Return on Equity (ROE / RoNW)

Financial Year | ROE (%) |

|---|---|

FY 2022–23 | 11.16% |

FY 2023–24 | 25.63% |

FY 2024–25 | 52.77% |

Sept 30, 2025 | 18.52% |

Weighted Average RoNW: 36.79%

Return on Capital Employed (ROCE)

Financial Year | ROCE (%) |

|---|---|

FY 2022–23 | 9.92% |

FY 2023–24 | 18.63% |

FY 2024–25 | 26.88% |

Sept 30, 2025 | 13.89% |

Net Worth (₹ in Lakhs)

Period | Net Worth (₹ Lakhs) |

|---|---|

FY 2022–23 | 380.67 |

FY 2023–24 | 844.98 |

FY 2024–25 | 1,537.44 |

Sept 30, 2025 | 1,851.27 |

Net Asset Value (NAV) per Equity Share

Period | NAV (₹ per share) |

|---|---|

FY 2022–23 | 48.71 |

FY 2023–24 | 97.32 |

FY 2024–25 | 24.67 |

Sept 30, 2025 | 29.71 |

Management Discussion and Business Strategy (MDA)

Management focuses on:

Expanding defence auto-tech vertical

Increasing government project share

Strengthening cybersecurity offerings

Improving operational efficiency

Purpose of the IPO (Use of Funds)

IPO proceeds will be used for:

Working capital requirements

General corporate purposes

Strengthening balance sheet

Pricing Logic and Valuation Basis

The issue price is determined through the book-building process, considering earnings, net worth, and industry benchmarks

Share Capital and Ownership Structure

The IPO consists of a fresh issue of 23,05,200 equity shares of face value ₹10 each.

Shareholding Pattern (Post-IPO)

Post listing, public shareholding will be approximately 27% of the paid-up capital

Dividend Policy

The company has not declared dividends historically and does not have a formal dividend policy

Related Party Dealings

List of Related Parties

Promoters & Key Managerial Personnel

Ms. Monicca Agarwaal – Promoter

Mr. Jai Prakash Pandey – Promoter & Director

Ms. Sonika Aggarwal – Promoter & Executive Director

Group / Related Entities

Marushika Infrastructure Services Private Limited

Dhruven Enterprises Private Limited

Naivedyam Info Solutions Private Limited

Marushika Technology Advisors PTE. Ltd. (Singapore) – Wholly Owned Subsidiary

Nature of Related Party Transactions

The Company has entered into the following transactions with related parties during the reported financial periods:

A. Transactions with Group Companies & Related Entities

Nature of Transaction | Related Party | FY 2024–25 (₹ Lakhs) | FY 2023–24 (₹ Lakhs) |

|---|---|---|---|

Purchase of services / expenses | Group entities | Disclosed | Disclosed |

Reimbursement of expenses | Group entities | Disclosed | Disclosed |

Support & operational services | Group entities | Disclosed | Disclosed |

(Amounts are aggregated and disclosed in the financial statements; transactions are not material in nature.)

B. Transactions with Promoters / Directors

Nature of Transaction | Related Party | Remarks |

|---|---|---|

Remuneration / salary | Promoters & Directors | As approved by Board & shareholders |

Sitting fees | Independent / Executive Directors | As per Companies Act |

Reimbursement of expenses | Promoters / Directors | Business-related |

Outstanding Balances with Related Parties

🔹 Trade & Other Payables / Receivables

Particulars | Sept 30, 2025 | Mar 31, 2025 |

|---|---|---|

Outstanding balances with related parties | Not material | Not material |

The RHP clearly states that no material outstanding balances with promoters or group entities exist that could adversely affect the Company’s financial position.

Arm’s Length & Governance Confirmation

As disclosed in the RHP:

All related-party transactions are conducted at arm’s length

Transactions are in the ordinary course of business

Approved by the Audit Committee

Disclosed as per Companies Act, 2013 and SEBI (ICDR) Regulations

Investor Takeaway

No diversion of funds to promoters or group entities

No material dependency on related-party revenues

Strong disclosure and governance compliance

Low related-party risk for public shareholders

Key Agreements and Legal Contracts

Key agreements include:

BRLM Agreement

Registrar Agreement

Market Maker Agreement

Issue Details and Allocation Structure

Category | Allocation |

|---|---|

QIB | Up to 50% |

NII | Minimum 15% |

Retail | Minimum 35% |

Other Statutory and Regulatory Disclosures

All disclosures by Marushika Technology Limited have been made in strict compliance with the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (SEBI ICDR) and the Companies Act, 2013, as amended from time to time, as stated in the Red Herring Prospectus (RHP).

The RHP contains true, fair, and adequate disclosures covering the company’s business operations, financial statements, risk factors, management discussion, legal matters, related-party transactions, corporate governance framework, and issue details. Mandatory disclosures relating to promoters, shareholding pattern, use of IPO proceeds, material contracts, litigations, and key financial ratios have been provided in the manner and format prescribed by SEBI ICDR Regulations.

Further, the company has ensured that:

All financial information is based on restated consolidated financial statements, audited and certified by independent chartered accountants

Disclosures comply with Schedule VI of the Companies Act, 2013 and applicable SEBI circulars and guidelines

Statutory approvals, licenses, and corporate actions are disclosed transparently

Ongoing disclosure obligations post-listing will be followed as per SEBI LODR Regulations

Accordingly, the RHP has been filed with the Registrar of Companies (ROC) and submitted to SEBI and the stock exchange, confirming adherence to all applicable legal and regulatory requirements governing public issues in India.

Rights of Equity Shareholders

(As disclosed in the RHP of Marushika Technology Limited)

As per the Red Herring Prospectus and in accordance with the Companies Act, 2013 and the Articles of Association of the Company, the equity shareholders are entitled to the following rights:

Voting Rights

Each equity share carries one vote

Shareholders are entitled to vote on all resolutions placed before the shareholders at general meetings

Voting may be exercised in person, through proxy, or electronically, as applicable under law

Voting rights are proportionate to shareholding

Dividend Rights

Equity shareholders are entitled to receive dividends, if and when declared

Dividend payment is subject to:

Availability of distributable profits

Board recommendation

Shareholder approval (where required)

The RHP also clarifies that the Company has not declared dividends historically and does not have a fixed dividend policy

Rights on Liquidation

In the event of winding up or liquidation, equity shareholders are entitled to:

Share in the residual assets of the Company

After settlement of all liabilities and preferential claims

Participation in Corporate Actions

Equity shareholders have the right to participate in:

Bonus issues

Rights issues

Stock splits or consolidation (if undertaken)

Any other corporate restructuring, as approved by shareholders and regulators

Transferability of Shares

Equity shares are freely transferable, subject to:

Applicable laws

Provisions of the Companies Act, 2013

SEBI regulations

Articles of Association

Rights to Information

Shareholders are entitled to receive:

Annual Reports

Audited financial statements

Notices of general meetings

Other statutory communications as required under law

Equal Ranking of Equity Shares

All equity shares issued under the IPO will rank pari passu with existing equity shares in respect of:

Voting rights

Dividend entitlement

Distribution of assets